Cash loans paid in 1 hour. Approval in seconds. Loans up to $1,500 Commercial Bridge Loans.

Tuesday, November 29, 2011

Friday, November 25, 2011

Monday, November 21, 2011

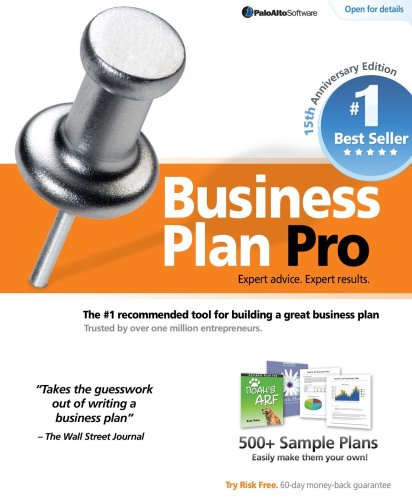

Business Plan Pro 15th Anniversary Edition [Download]

!: Promotion Business Plan Pro 15th Anniversary Edition [Download] where to buy

| Price : $69.99

| Price : $69.99Post Date : Nov 21, 2011 20:09:32 | Usually ships in 1-2 business days

Need a business plan to start or grow your business? Business Plan Pro software is the fastest, easiest way to create a business plan. With prebuilt spreadsheets, SBA-approved document output, and expert guidance at every step, Business Plan Pro enables any business owner or entrepreneur to produce a complete, accurate plan with a minimum of time and expense. Write your business plan quickly and easily Business Plan Pro has everything you need to create a plan today, all proven and error free. The software automatically customizes your plan outline to match your business type. Just answer a few simple questions and you're on your way to creating a professional business plan that gets results. The software automatically creates the spreadsheets, charts and graphs that investors are looking for. Business Plan Pro allows you to focus your time on executing your business strategy and growing your business. Simple or detailed, it's your choice New for 2009, Business Plan Pro has a "keep it simple" option to get from start to finish in less than 15 steps. No other software offers a faster way to get your business plan done. If you need more, you can expand your plan at any point to provide the financial and strategic details you want, including SWOT analysis, marketing strategy, and web site plan. Recommended by experts, trusted by entrepreneurs Business Plan Pro is the most popular business plan software on the market for nearly a decade, outselling all others combined. It is the recommended choice of: • The Wall Street Journal • Entrepreneur Magazine • PC World • Inc.com • PC Magazine • Guy Kawasaki Get started quickly with 500+ sample business plans Say goodbye to writer's block. Business Plan Pro comes with over 500 real business plan examples to give you inspiration. You can browse the sample plan library by industry type, view a summary of each plan, or skim plans in a printable format.

- Over 500 editable sample business plans included for all sorts of businesses; find a sample plan and use it as a guide to write your own

- Easy step-by-step instructions and expert guidance every step of the way; get from start to finish in less than 15 steps

- Built-in market research for 9,000+ industry profiles; compare your projections to industry averages

- Printed and electronic document output options in SBA and lender-preferred formats; export to Microsoft Word or Excel, or to Adobe PDF format

- New for 2008 features include streamlined plan setup, new options for simpler business plans, Spanish language support, certification for Windows Vista, and an improved user interface

Friday, November 18, 2011

Thursday, November 17, 2011

Bounty Hunter LONESTAR Lone Star Metal Detector

!: Saving Bounty Hunter LONESTAR Lone Star Metal Detector save you money!

Brand : Bounty HunterRate :

Price : $135.12

Post Date : Nov 17, 2011 09:18:03

Usually ships in 24 hours

The Lone Star is an advanced technology metal detector, designed for a variety of applications including coin shooting, relic hunting, and general purpose detecting. The unit provides target identification and mode in an easy to read LCD display. Standard features include a built-in speaker, headphone jack and adjustable aluminum stem with an ergonomic S-Rod handle and armrest. All this is backed by Bounty Hunters exclusive five-year limited warranty.

!: Kitchen Composter Freestanding Range Help Bargain Sale Ernie Ball Jr Volume Pedal

Saturday, November 12, 2011

Wednesday, November 9, 2011

Monday, November 7, 2011

|

|

|

|

|

|

|

|

Sponsor Links

- Products Discount Today

- Best Buy Vacuum Cleaner Reviews

- Sports Fitness Mall

- Best Price Gopro Hd Motorsports

- Refurbished Dyeables Women's Holly Sandal...

- Coupon Zeus Ptfe (teflon) Regular Wall Tubing 20 Gauge 1000' Length Spool Or Coil...

- Purchasing Hoover U5140900

- Used Tibet Plateau Soft Soled Infant Leather Baby Shoes Suede Koala Red...

- Promotions Earmuffs For

- 24 Lcd Displays Compare