Cash loans paid in 1 hour. Approval in seconds. Loans up to $1,500 Commercial Bridge Loans.

Wednesday, December 21, 2011

Wednesday, December 14, 2011

Wednesday, December 7, 2011

Tuesday, November 29, 2011

Friday, November 25, 2011

Monday, November 21, 2011

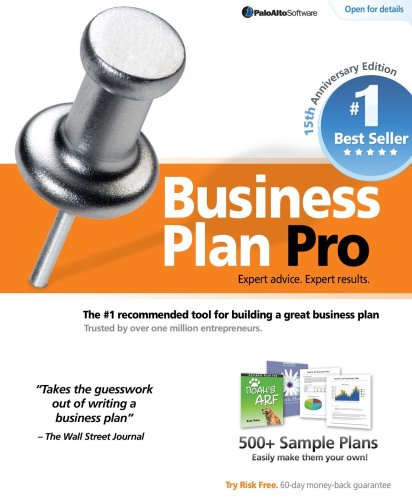

Business Plan Pro 15th Anniversary Edition [Download]

!: Promotion Business Plan Pro 15th Anniversary Edition [Download] where to buy

| Price : $69.99

| Price : $69.99Post Date : Nov 21, 2011 20:09:32 | Usually ships in 1-2 business days

Need a business plan to start or grow your business? Business Plan Pro software is the fastest, easiest way to create a business plan. With prebuilt spreadsheets, SBA-approved document output, and expert guidance at every step, Business Plan Pro enables any business owner or entrepreneur to produce a complete, accurate plan with a minimum of time and expense. Write your business plan quickly and easily Business Plan Pro has everything you need to create a plan today, all proven and error free. The software automatically customizes your plan outline to match your business type. Just answer a few simple questions and you're on your way to creating a professional business plan that gets results. The software automatically creates the spreadsheets, charts and graphs that investors are looking for. Business Plan Pro allows you to focus your time on executing your business strategy and growing your business. Simple or detailed, it's your choice New for 2009, Business Plan Pro has a "keep it simple" option to get from start to finish in less than 15 steps. No other software offers a faster way to get your business plan done. If you need more, you can expand your plan at any point to provide the financial and strategic details you want, including SWOT analysis, marketing strategy, and web site plan. Recommended by experts, trusted by entrepreneurs Business Plan Pro is the most popular business plan software on the market for nearly a decade, outselling all others combined. It is the recommended choice of: • The Wall Street Journal • Entrepreneur Magazine • PC World • Inc.com • PC Magazine • Guy Kawasaki Get started quickly with 500+ sample business plans Say goodbye to writer's block. Business Plan Pro comes with over 500 real business plan examples to give you inspiration. You can browse the sample plan library by industry type, view a summary of each plan, or skim plans in a printable format.

- Over 500 editable sample business plans included for all sorts of businesses; find a sample plan and use it as a guide to write your own

- Easy step-by-step instructions and expert guidance every step of the way; get from start to finish in less than 15 steps

- Built-in market research for 9,000+ industry profiles; compare your projections to industry averages

- Printed and electronic document output options in SBA and lender-preferred formats; export to Microsoft Word or Excel, or to Adobe PDF format

- New for 2008 features include streamlined plan setup, new options for simpler business plans, Spanish language support, certification for Windows Vista, and an improved user interface

Friday, November 18, 2011

Thursday, November 17, 2011

Bounty Hunter LONESTAR Lone Star Metal Detector

!: Saving Bounty Hunter LONESTAR Lone Star Metal Detector save you money!

Brand : Bounty HunterRate :

Price : $135.12

Post Date : Nov 17, 2011 09:18:03

Usually ships in 24 hours

The Lone Star is an advanced technology metal detector, designed for a variety of applications including coin shooting, relic hunting, and general purpose detecting. The unit provides target identification and mode in an easy to read LCD display. Standard features include a built-in speaker, headphone jack and adjustable aluminum stem with an ergonomic S-Rod handle and armrest. All this is backed by Bounty Hunters exclusive five-year limited warranty.

!: Kitchen Composter Freestanding Range Help Bargain Sale Ernie Ball Jr Volume Pedal

Saturday, November 12, 2011

Wednesday, November 9, 2011

Monday, November 7, 2011

Friday, October 28, 2011

Saturday, October 22, 2011

Interlibrary Loan Practices Handbook, Third Edition

!: Comparison Interlibrary Loan Practices Handbook, Third Edition fast

Brand :Rate :

Price : $80.99

Post Date : Oct 22, 2011 13:58:03

Usually ships in 24 hours

In their definitive new Interlibrary Loan Practices Handbook, editors Weible and Janke clearly explain

the complexities of getting materials for patrons from outside the library. This collection presents a

complete view of the interlibrary loan (ILL) process, with contributions from all areas of the technical

services community, providing

- Guidance on how to do ILL efficiently and effectively, with advice on how to be a considerate

borrower and lender - Details of preferred staffing and management techniques, showing how best practices can be

implemented at any institution - Discussion of important issues that can fall between the cracks, such as hidden copyright issues,

and the logistics of lending internationally

this book gives library staff the tools necessary for a smoothly functioning ILL system.

Saturday, April 16, 2011

Strong resolve and a disaster loan help business rebuild after Katrina.: An article from: Mississippi Business Journal

!1: Now is the time Strong resolve and a disaster loan help business rebuild after Katrina.: An article from: Mississippi Business Journal Order Today!

This digital document is an article from Mississippi Business Journal, published by Thomson Gale on April 23, 2007. The length of the article is 1044 words. The page length shown above is based on a typical 300-word page. The article is delivered in HTML format and is available in your Amazon.com Digital Locker immediately after purchase. You can view it with any web browser.

Citation Details

Title: Strong resolve and a disaster loan help business rebuild after Katrina.

Author: Jennifer Ekman

Publication:Mississippi Business Journal (Magazine/Journal)

Date: April 23, 2007

Publisher: Thomson Gale

Volume: 29 Issue: 17 Page: S20(1)

Distributed by Thomson Gale

!: Oakley Gascan Grand Sale !: Radio Controlled Wrist Watches Quiz

Tuesday, April 5, 2011

Introduction to Commercial Bridge Loans

The commercial bridge loan is unique in that its intended purpose is simply to stabilize a situation and buy time. Let's take a closer look at how this financing works.

A bridge loan is named correctly. While it has nothing to do with a pathway over something, it is definitely is designed to bridge a time gap. Let's consider the simplest of situations.

Commercial Bridge Loans

You have a commercial building that is providing positive income. The financing is set to run out in 2010. The Great recession hits in 2008 and you realize that the balloon payment you have coming due in 2010 is going to be nearly impossible to meet. What do you do? Getting a long term loan during the uncertainty of the 2008 and 2009 period was difficult at best. The answer for many was to look to bridge loans because they provided financing that would carry the property through to a period when things had settled down, to with, 2012 or 2013.

!1: Now is the time Strong resolve and a disaster loan help business rebuild after Katrina.: An article from: Mississippi Business Journal Order Today!

This digital document is an article from Mississippi Business Journal, published by Thomson Gale on April 23, 2007. The length of the article is 1044 words. The page length shown above is based on a typical 300-word page. The article is delivered in HTML format and is available in your Amazon.com Digital Locker immediately after purchase. You can view it with any web browser.

Citation Details

Title: Strong resolve and a disaster loan help business rebuild after Katrina.

Author: Jennifer Ekman

Publication:Mississippi Business Journal (Magazine/Journal)

Date: April 23, 2007

Publisher: Thomson Gale

Volume: 29 Issue: 17 Page: S20(1)

Distributed by Thomson Gale

The thing to understand with commercial bridge loans is they are like a shot of alcohol. They are very compressed, pack a punch and you have to be careful when using them so that you don't feel terrible the metaphorical next morning! Since the loans cover such short periods, they usually come with large point charges and high interest rates. The good news is they tend to also be put in place very fast. Turn around times are as short as 30 to 45 days and sometimes faster.

Commercial bridge loans are highly dependent upon the state they are in and the specific situation. They are sometimes referred to as panic loans because they are usually only made when a borrower has exhausted more traditional financing options. Lenders know this and there is a certain predatory lean to their lending efforts in this area. This is why it is critical to use an independent broker that knows how to keep you from being taken advantage of. A fair price is a fair price, but some lenders will go above and beyond that. Having someone in your corner who can call their bluff is vital.

Introduction to Commercial Bridge Loans!: Illuminated Magnifier Tips !: Blues Brothers Wayfarer Dark Black Sun Glasses Gravity Shades !: Gatorade Grape Powder

Sunday, March 27, 2011

CMBS: crossing the bridge. (commercial mortgage-backed securities): An article from: Mortgage Banking

!1: Now is the time CMBS: crossing the bridge. (commercial mortgage-backed securities): An article from: Mortgage Banking Order Today!

This digital document is an article from Mortgage Banking, published by Mortgage Bankers Association of America on July 1, 1998. The length of the article is 3288 words. The page length shown above is based on a typical 300-word page. The article is delivered in HTML format and is available in your Amazon.com Digital Locker immediately after purchase. You can view it with any web browser.

Citation Details

Title: CMBS: crossing the bridge. (commercial mortgage-backed securities)

Author: Joe Rubin

Publication:Mortgage Banking (Magazine/Journal)

Date: July 1, 1998

Publisher: Mortgage Bankers Association of America

Volume: v58 Issue: n10 Page: p10(6)

Distributed by Thomson Gale

!: Comment Online Business Loan !: Jewish Chocolate Coins !: Buying Schwinn Recumbent Bike 240

Saturday, March 19, 2011

The Mortgage Encyclopedia : The Authoritative Guide to Mortgage Programs, Practices, Prices and Pitfalls, Second Edition

!1: Now is the time The Mortgage Encyclopedia : The Authoritative Guide to Mortgage Programs, Practices, Prices and Pitfalls, Second Edition Order Today!

The bestselling one-stop guide to mortgages—updated for the post–housing crisis market! The Mortgage Encyclopedia demystifies all the various mortgage terms, features, and options by offering clear, precise explanations. Fully updated to address the new realities introduced by the housing crisis of 2007, The Mortgage Encyclopedia provides not just a complete description, but also in-depth discussion of the issues that may affect you, whether you're a homeowner (or homeowner-to-be), real estate agent, loan provider, or attorney. With this handy, comprehensive guide on hand, you have instant access to: Definitions and explanations of common mortgage-related terms, as well as arcane mortgage terminology, listed alphabetically Expert advice on the most pressing issues, such as whether to use a mortgage brokers, the benefits of paying points versus a larger down payment, and the hazards of cosigning a loan The truth about common mortgage myths and misperceptions—and the pitfalls you need to avoid Helpful tables on affordability, interest cost of fixed-rate versus adjustable rate mortgages, and much more So the next time you ask yourself such questions as "Is this FHA loan right for me?" or "Can I negotiate this fee?" reach for this indispensable guide and get the fast, accurate information you need!

!: Answer Electric Tree Pole Saw !: Interview Coleman Pressure Washer Parts !: Wenger Luggage Compare

Friday, March 11, 2011

Commercial Bridge Loan Financing - Fast Closing Commercial register bridge loan programs

www.us-finance-solutions.com A commercial bridging loan may be just what your company to make it through a difficult time or just to get only as a commercial bridge loan, until longer-term secured commercial financing needs. U.S. financing solutions, Inc. in connection with and Randolph Capital, LLC can help your company to acquire a fast hard money commercial bridge loan. commercial bridge loan is a great alternative to having to sell assets or investments to solve a short-term liquidity or other problem.

Tags: commercial bridge loan, commercial bridge financing, fast commercial loan, commercial bridge mortgage, commercial bridge loans

!: Last Minute Home Electric Generators !: Double Oven Gas Stove Tips Wiki

Monday, March 7, 2011

Lower rate loan draws more bridge loan biz.(Kennedy Funding's new loan rates): An article from: Real Estate Weekly

!1: Now is the time Lower rate loan draws more bridge loan biz.(Kennedy Funding's new loan rates): An article from: Real Estate Weekly Order Today!

This digital document is an article from Real Estate Weekly, published by Hagedorn Publication on June 8, 2005. The length of the article is 589 words. The page length shown above is based on a typical 300-word page. The article is delivered in HTML format and is available in your Amazon.com Digital Locker immediately after purchase. You can view it with any web browser.

Citation Details

Title: Lower rate loan draws more bridge loan biz.(Kennedy Funding's new loan rates)

Author: Jeffrey Wolfer

Publication:Real Estate Weekly (Magazine/Journal)

Date: June 8, 2005

Publisher: Hagedorn Publication

Volume: 51 Issue: 43 Page: S4(1)

Distributed by Thomson Gale

|

|

|

|

|

|

|

|

Sponsor Links

- Products Discount Today

- Best Buy Vacuum Cleaner Reviews

- Sports Fitness Mall

- Best Price Gopro Hd Motorsports

- Refurbished Dyeables Women's Holly Sandal...

- Coupon Zeus Ptfe (teflon) Regular Wall Tubing 20 Gauge 1000' Length Spool Or Coil...

- Purchasing Hoover U5140900

- Used Tibet Plateau Soft Soled Infant Leather Baby Shoes Suede Koala Red...

- Promotions Earmuffs For

- 24 Lcd Displays Compare

Great Deal : $9.95Date Created :Apr 16, 2011 19:21:14

Great Deal : $9.95Date Created :Apr 16, 2011 19:21:14